The rating agency Fitch Ratings has downgraded Ukraine's credit rating. What is important to understand is primarily related to the start of the restructuring of Eurobonds.

Points of attention

- The adoption of the law and the start of the restructuring of Eurobonds opens the way for the exchange of problematic debt and simplifies the conditions for repaying Ukraine's external debt.

- Creditors agreed to write off 37% of Eurobond debt, and Ukraine offered new series A and B bonds to repay the debt in the future.

- The restructuring of Ukraine's external state commercial debt should solve financial difficulties and help ensure the stability of the country's economy.

What is known about the downgrade of Ukraine's credit rating

It is worth noting that this is currently a temporary solution.

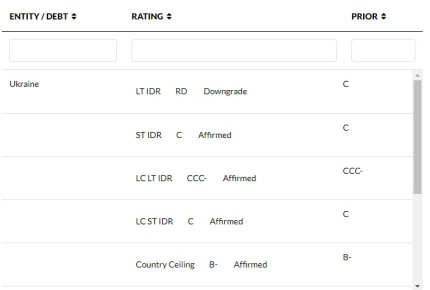

It is indicated that Fitch Ratings has downgraded Ukraine's rating from "C" to "RD" level (limited default), and Eurobonds-2026 for $750 million, on which Ukraine has not paid the coupon, to "D" level.

The downgrade to "RD" follows the end of the 10-day grace period for the payment of coupon income on Eurobonds for 750 million dollars, which was supposed to take place on August 1. This means default according to Fitch's criteria, the message says.

As mentioned earlier, a month ago, the Verkhovna Rada of Ukraine passed a law that enabled the Cabinet of Ministers to temporarily suspend payments on state and state-guaranteed external debt until the restructuring agreement with creditors is completed.

On August 9, the Ukrainian government officially announced the start of the procedure for obtaining consent for the restructuring of Eurobonds.

According to Fitch Ratings, such an operation is an exchange of problematic debt, because it is about writing off part of the body of the loan and interest, as well as extending the maturity of the bonds.

What is known about the latest decisions of Ukraine

Last month, I agreed with the Committee of Eurobond owners regarding the comprehensive restructuring of the external state commercial debt.

First of all, it is said that the creditors will write off 37% of the Eurobond debt to Ukraine. Instead, Kyiv will offer new Eurobonds:

Series A bonds — for 40% of the debt amount with repayments in February 2029, 2034, 2035 and 2036. Interest payments on these papers will be made as early as August 1, 2024. The interest rate will be 1.75% until August 1, 2025, 4.5% until February 1, 2026, 6% until August 1, 2027, and 7.75% starting from February 1, 2034. Interest will be paid every six months.

It is also about bonds of series B — for 23% of the debt with repayments in February 2030, 2034, 2035 and 2036. Interest payments will not be made until February 1, 2027, in August 2027-2033 — 3%, and starting from February 1, 2034 — 7.75%.

More on the topic

- Category

- Economics

- Publication date

- Додати до обраного

- Category

- Technology

- Publication date

- Додати до обраного