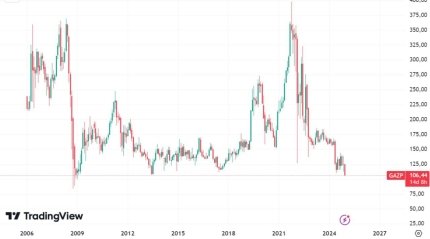

Shares of Russian gas monopoly Gazprom have plummeted to 106 rubles. What is important to understand is that this is the lowest level in the last 15 years.

Points of attention

- Gazprom shares have been showing a steady decline for a long time.

- The decline in share prices was influenced by the European Commission's decision on the possible disruption of Russian gas transit, which exacerbated the situation on the market.

- Find out the decisions of EU countries to combat the Russian shadow fleet.

Gazprom shares are steadily falling in price

According to trading data on the Moscow Exchange, the price fell as low as 106.44 rubles.

Analysts point out that the last time the shares of the Russian monopolist were so cheap was 15 years ago, in January 2009.

Earlier, due to the fall in the ruble exchange rate against the dollar, Gazprom shares fell to almost $1.

The Russian publication The Moscow Times, which positions itself as opposition, notes that stocks began falling about a week ago.

According to journalists, this happened after the European Commission's statement that official Brussels is ready to stop the transit of Russian gas and does not expect a significant impact on prices.

On December 17, the European Commission made it clear that the bloc is ready to terminate the transit agreement and has alternative sources of supply.

12 European Union countries decided to jointly confront the Russian shadow fleet

On December 17, the results of the JEF leaders' summit held in Estonia became known.

Denmark, Estonia, Finland, Germany, Iceland, Latvia, Lithuania, the Netherlands, Norway, Poland, Sweden and the United Kingdom have agreed to jointly oppose Russia's use of a shadow fleet to transport its own oil to circumvent sanctions.

"We are united in our shared determination to take further coordinated steps to disrupt and deter Russia's shadow fleet, confront the risks it poses, and work together to prevent illicit operations and increase Russia's spending," the JEF leaders said in a joint statement.

The summit participants draw attention to the fact that Russia's use of a shadow fleet to sell its own oil in circumvention of Western sanctions poses risks to the environment, maritime security, international maritime trade, and international maritime navigation.